Three advices to NEO Finance investors

We are constantly aiming for the information on investing to be available as simply and clearly as possible, therefore, we always consider your comments, as well as frequently asked questions.

This time, we are going to answer the following questions:

1. What is NEO Finance account aimed for?

2. What is automatic investment and how to use it?

3. What is secondary market and how to work there?

We hope that the answers will be useful, and will help you choose the most appropriate investment strategy.

1. What is NEO Finance account aimed for?

Due to the unlimited e-money institution licence held by NEO Finance, which allows operations in entire European Union, each client of the company is granted a free-of-charge personal account. With this account, safety of client funds is ensured: these funds are kept in an account in the Bank of Lithuania, separate from that where the company funds are kept.

This account is the same as any bank account: it has its own IBAN number, therefore, can be used not only for investing on NEO Finance platform, but for all other banking operations, such as settling payments on e-shops, transferring one‘s salary, executing other operations as needed. Basically, the system of NEO Finance is a banking system.

The account can be topped up as follows: Via basic banking transfer, by indicating one‘s NEO Finance account number seen on the „Account“ section, as well as one‘s first and last name. In terms of timing, the money will be deposited in a regular timeline of the bank.

The first money transfer must be executed from one‘s personal bank account, since the account will later be used for money withdrawal.

2. What is automatic investment and how to use it?

Automatic investment function enables the investors to select investment criteria in advance. Based on the criteria selected, the robot will invest the money. Criteria to be selected can be: credit amount, maturity, interest rate, etc. It is recommended to carefully rethink the criteria: the more criteria is included in the auto-invest rule, the lesser the possibility to find the preferable credit.

In addition to the credit criteria, the investors might also choose the amount of money that they are willing to dedicate to a particular auto-invest rule („Maximum amount of this automatic investment“), as we as the money dedicated to each credit („Maximum amount for one loan“).

This way of investing saves time, since the investor is not obliged to dedicate their time for browsing the market looking for the credits to invest to.

Important: while creating a new auto-invest rule, it is recommended to pay attention to the information on the right handside of the page: information regarding corresponding credits financed in the past is presented there.

The most common mistakes, while creating an auto-invest rule:

- An inadequate education of the borrower is selected (does not correspond to one‘a age and / or creditworthiness rating).

- Too little amount of money is selected for investment.

- Frequent updates of the auto-invest rule, which influences the order of investors.

- The order of investors holding the auto-invest rules is established as follows: (i) Rules with the lowest annual interest rate. E.g., if one rule is set to start from 7%, while the other is set from 8%, the rule with 7% will always be prioritised. (ii) Rules of VIP investors. (iii) According to the date, starting from the oldest rule.

More information.

3. What is secondary market and how to work there?

Secondary market is the possibility for investors to buy and / or sell the already-confirmed investments in credits. The investments might be sold with a premium (+X%), or a discount (-X%). It already is reflected in the selling price.

Premium – a margin applied by the investment seller, calculating from the residual part of the credit. Applied when the investment is sold at a more expensive price than was bought.

Discount – a discount applied by the seller, calculating from the residual part of the credit. Applied when the investment is sold at a cheaper price than was bought.

An intermediary fee of 1% is applied while both selling, as well as buying, the investments. The fee is calculated based on the selling price of the investment.

Reasons for buying:

- Possibility to buy the already-confirmed investments at a cheaper price than in the primary market (when buying with a discount).

- Primary market does not offer the credits which are attractive for a particular investor.

- Buying default credits with a big discount, expecting for a successful recovery.

- Possibility to see the solvency history of a particular investment.

- Possibility to buy an investment for less than EUR 10.

Reasons for selling:

- Possibility to earn while selling an investment with a premium.

- Aim for a quick cash withdrawal.

- Wish to dismiss particular investment which seems unattractive to the investor.

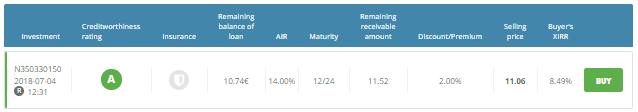

Example: Buying the investment

a) Investment is sold with a premium (2%)

10.74 (residual part of the investment) + (10.74 * 2.00/100 (premium)) = 10.95 + 0.11 (intermediary fee 1%) = 11.06 (selling price)

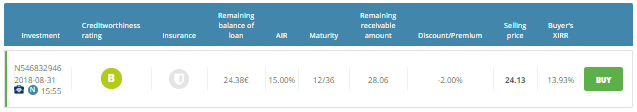

b) Investment sold with a discount (-2.00%)

24.38 (residual part of the investment)+ (24.38 * (-2.00/100) (discount)) = 23.89 + 0.24 (intermediary fee 1%) = 24.13 (selling price)

Earnings of the buyer = Residual amount receivable - Selling price

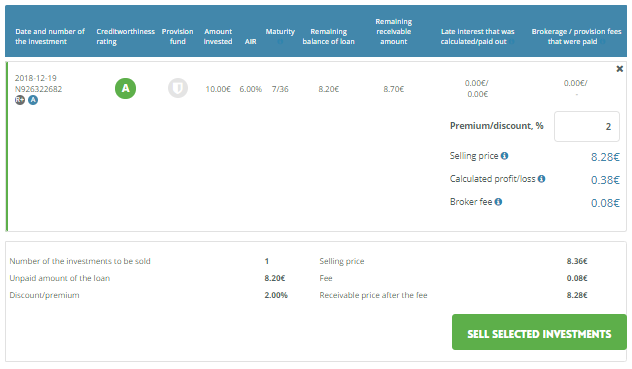

Example: Selling the investment

a) Investment is put in the secondary market with a premium (2%)

8.20 (residual part of the loan) + (8.20*2.00/100 (premium)) = 8.36 (selling price)

8.20*2.00/100 (premium) + 0.30 (interest received) - 0.08 (1% intermediary fee) = 0.38 (calculated profit)

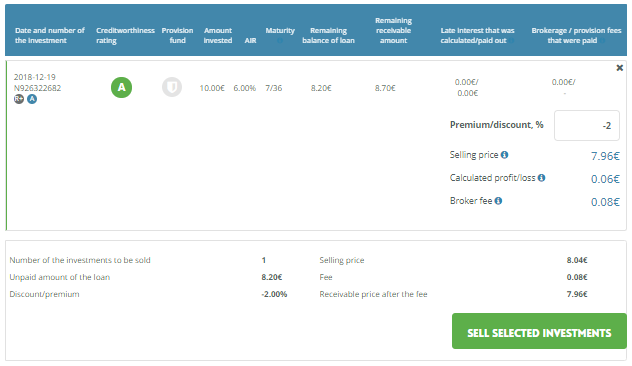

b) Investment is put in the secondary market with a discount (-2%)

8.20 (residual part of the loan) + (8.20*(-2.00)/100 (discount)) = 8.04 (selling price)

(8.20*(-2.00)/100) (discount) + 0.30 (interest received) - 0.08 (1% intermediary fee) = 0.06 (calculated profit)

Earnings of the seller = Premium / Discount + Interest - Intermediary fee