TAXATION OF THE INTEREST PAID OUT TO THE FOREIGN COUNTRY RESIDENTS

IMPORTANT NOTICE

NEO Finance is not a certified tax advisor and therefore we not provide an official interpretation of the legislation of taxes in Lithuania or other respective country where investor is a tax resident. It is the sole responsibility of the individual investor to ensure that the requirements described apply to him. Please note that the following information is only intended to give an overview of taxation principles and does not constitute advice for individual cases. We therefore ask you to be advised individually by a licensed tax consultant or tax administrator of the respective country where you are a tax resident.

General information of non-lithuanian residents

The income earned at NEO Finance is taxed for each investor based on the legislation of the Lithuania and of the respective country where the investor is a tax resident.

Interest paid to the foreign country residents are classified as the A-class income and the resident income tax (hereinafter – RIT) for them must be deducted and paid by the subject paying out the interest. In this case, it is "NEO Finance".

Profit of the foreign country residents received from the trade of investments in the secondary market or from selling investments to "NEO Finance", is not considered as an object of the income tax in Lithuania. Therefore, foreign country residents do not have to pay taxes in Lithuania for this income.

Every non-Lithuanian resident must pay income tax from received interest in Lithuania. NEO Finance has a duty to deduct and pay taxes to Lithuanian budget. Profit of the foreign country residents received from the trade of investments in the secondary market or from selling investments to NEO Finance, is not considered as an object of the income tax in Lithuania. Therefore, foreign country residents do not have to pay taxes in Lithuania for this income.

Also, investor may pay taxes in the country of his/her residence, so every investor should consult with a licensed tax consultant or a tax administrator. Detailed information of taxation for residents of Germany, Latvia, Spain and Netherlands is provided below.

Submitting the details of residence

Investors of "NEO Finance" will have to fill in the information regarding the confirmation of their country of residence, by signing in to their account. New investors of "NEO Finance" will have to provide these details during the registration.

Changing the details of residence

If the country of residence changes, investors of "NEO Finance" will have to amend their details of residence. They will be able to do so in their "NEO Finance" account settings.

Presenting the application to reduce the deducted tax

Since July 2017, "NEO Finance" automatically deducts residents income tax (RIT) equal to 15% from the interest paid out to the non-residents of Lithuania. When a foreign country resident whose country of residence has a double taxation avoidance agreement (hereinafter - DTAA) with Lithuania presents a DAS-1 form to reduce the tax deducted, "NEO Finance" will apply the reduced RIT rate to the investor and they will be deducted 10% or, in the case of Latvia, UAE and Cyprus – 0%.

(Here is an example how to fill in DAS-1 form).

The investor should fill in sections I through IV in the aforementioned application by themselves, section V should be filled by the representative of tax administrator of the respective foreign country, and section VI should be left blank. Section V of the DAS-1 form can be left blank if the foreign country resident provides a certificate of the foreign tax administrator that they are a resident of that country.

The DAS-1 form is valid only in the calendar year indicated by the foreign tax authority, by confirming the information provided in Part V of this form.

Non-residents of Lithuania will be able to submit the aforementioned documents by signing in to their "NEO Finance" investor account.

Tax-free Income (For incomes from 2018)

Non-taxable income includes interest from consumer credit provided through P2P platforms not exceeding EUR 500 per tax period. Foreign country residents can only benefit from this tax relief after the tax period has ended. This means that from the interest paid to non-residents, “NEO Finance” automatically deducts income tax, but the person will have the right to apply to the State Tax Inspectorate for a refund of the deducted tax.

Application of the foreign country resident to refund the deducted tax

If the foreign country resident did not exercise their right to submit the DAS-1 form to "NEO Finance", then such investor can apply to the State Tax Inspectorate (hereinafter – STI) with an application of DAS-2 form to refund the deducted tax. Also, the DAS-2 form may be provided for withholding tax on interest received, which did not exceed EUR 500.

Reduction of taxes payable in own country of residence

Foreign country residents will be able to reduce taxes paid in their country of residence for the interest paid out by "NEO Finance", by the amount of income tax deducted and paid in Lithuania.

It should be noted that foreign country residents can reduce the taxes paid in their country by the amount of the deducted and paid tax only if "NEO Finance" is presented with the DAS-1 form. If the form is not presented, foreign country resident will be able to reduce taxes payable in their country of residence by the maximum amount of the income tax rate specified in the respective DTAA. For example, if the foreign country resident earned 1000 EUR of interest but had not submitted application of DAS-1 form before, 15% rate would be applied and 150 EUR deducted. If Lithuania and the country of residence of this investor had DTAA in place with a maximum specified income tax rate of 10%, in this case, taxes payable in their own country of residence could be reduced by 100 EUR. If the foreign country resident had presented the DAS-1 form, then the rate of 10% would have been applied and 100 EUR deducted, and taxes paid in the country of their residence could have been reduced by this amount.

When seeking to reduce taxes paid in your own country of residence, you should contact STI and present them (directly or via mail) with certificate of DAS-3 form about income received and taxes paid in the Republic of Lithuania. Another alternative is to present an application to issue a certificate FR0595. This certificate can be ordered by (1) sending the application via mail, (2) contacting the STI directly, or (3) electronically, by logging into "Mano VMI" (My STI) – a section of authorised electronic services of the State Tax Inspectorate webpage. The certificate received should be presented to the tax administrator of the own country of residence.

Required forms:

Form DAS-1 (FR0021) PDF

Form DAS-1 (FR0021) PDF EXAMPLE how to fill in

Form DAS-2 (FR0022) PDF

Form DAS-3 (FR0023) PDF

Application to issue the certificate of form FR0595 of the PDF

Instructions on how to fill in the DAS-1 form PDF

Under German tax law, investors must pay tax on income from capital assets. The taxation on investment on the P2P platform is subject to any received interest income and capital gains from the trade of investments in the secondary market or from selling investments to NEO Finance during the tax assessment period.

Tax rates

Interest and capital gains of retail investors resident in Germany are subject to withholding tax of 25% plus a 5.5% solidarity surcharge (effectively 26.375%). Depending on the individual situation of the individual investor, church tax (8 or 9% depending on the federal state) may also be applied. Basically, the withholding tax is independent of the personal progressive tax rate. It has a final effect.

German income tax calculation

The taxable amount is the gross interest income without deduction of income-related expenses. Expenses related to investing on the NEO Finance platform are not deductible to the investor. A standard annual deduction of EUR 801/1,602 (single/married) is offset against the taxable part of worldwide investment income.

For the taxation of the potential capital gain on a sale of secondary market loans, the net profit is the taxable amount. The taxable capital gain is determined by the selling price less costs of disposal and acquisition.

Examples:

No. 1

Main clauses: i) During 2019 investor earned EUR 400 interest; ii) DAS-1 form was provided to the NEO Finance; iii) Investor apply to the Lithuanian State Tax Inspectorate for a refund of the deducted tax from received interest.

Taxes in Lithuania

From EUR 400 NEO Finance deduct 10% of income tax. The deducted income would be EUR 40, but in this example, we are assuming that investor will apply for a refund of the deducted tax and after the tax period has ended investor would get back EUR 40 of deducted taxes.

Taxes in Germany

Applying the withholding tax of 25% plus solidarity surcharge of 5.5%, the income tax for this income would be EUR 105.5 (total of 26.375% of the received interest income, apart from any church tax due), before taking into account any applicable saver lump sum. Assuming that the saver lump sum of EUR 801 is applicable and the total investment income from other sources does not exceed the lump sum of EUR 801, no tax would be payable.

Taxes in total EUR 0.

No. 2.

Main clauses: i) During 2019 investor earned EUR 400 interest; ii) DAS-1 form was provided to the NEO Finance; iii) Investor doesn’t apply to the Lithuanian State Tax Inspectorate for a refund of the deducted tax from received interest.

Taxes in Lithuania

From EUR 400 NEO Finance deduct 10% of income tax. The deducted income would be EUR 40.

Taxes in Germany

Applying the withholding tax of 25% plus solidarity surcharge of 5.5%, the income tax for this income would be EUR 105.5 (total of 26.375% of the received interest income, apart from any church tax due), before taking into account any applicable saver lump sum. Assuming that the saver lump sum of EUR 801 is applicable and the total investment income from other sources does not exceed the lump sum of EUR 801, no tax would be payable.

Taxes in total EUR 40.

Latvian income tax calculation

In accordance with the regulatory requirements below, the tax is to be calculated once a year for each previous investment year (calendar year) as follows:

A. Refunds received * minus

B. Amount of investment **

If A.> B. then the taxable income for the tax year must be calculated as the excess of the repayments received over the amount of the investment made. If B.> A. then the taxable income for the tax year is 0.

Taxable income and tax payable must be calculated, declared and paid to the SRS in the following tax year, after the receipt of income. The income tax return must be filed the following year after the income is earned from March 1 to June 1. If the income for the tax year 2019 is more than EUR 62 800 - from 1 April to 1 July.

Tax rate applicable from January 1, 2019, payable on annual taxable income:

1) 20 percent - for annual income up to EUR 20,004;

2) 23 per cent - for the part of the annual income which exceeds EUR 20,004, but does not exceed the maximum amount of the object of compulsory contributions determined in accordance with the Law On State Social Insurance;

3) 31.4 per cent - for the part of the annual income that exceeds the maximum amount of the obligatory contribution subject to the State Social Insurance Act (EUR 62,800 in 2019)

If the estimated tax is <640 euros, you must pay it within 15 days of the date of the statutory return. If the estimated tax is> 640 euros - can be paid in one or three instalments (until 16 June, 16 July 16 August), paying one third of the amount of the tax each time

Examples:

Main clauses: i) Investor invested EUR 400 to a 2-year term loan in January of 2018; ii) DAS-1 form was provided to the NEO Finance.

Taxes in Lithuania

According to the double taxation avoidance agreement between Lithuania and Latvia tax rate of received interest is 0% and no tax would be payable.

Taxes in Latvia

The investor makes an investment of EUR 400 on January 1, 2018 in one loan. Under the agreement, the investor will receive payments for 2 years, receiving a monthly payment of EUR 24(EUR 288 per year, EUR 576 for 2 years).

2018

The taxable income from this investment in 2018 will be EUR 0, as the payments received (EUR 288) do not exceed the initial investment (EUR 400). Accordingly, the investor does not declare or pay tax on the investment.

2019

The taxable income from this investment in 2019 will be EUR 176, because the total payments received (EUR 288 in 2018, EUR 288 in 2019) will exceed the original investment (400 EUR) and taxable income for EUR 176. This income will be taxed at the applicable personal income tax rate of 20% *, which is currently EUR 35.2. The tax should be calculated, declared and paid in the following year.

Taxes in total: EUR 35.2.

No. 2.

Main clauses: i) Investor invested EUR 400 to a 2-year term loan in January of 2019; ii) The investor has received 3 payments of EUR 24 from the time of purchase of the investment (total EUR 72 from which EUR 45 was interest) and sold the investment on the secondary market for EUR 370; iii) DAS-1 form was not provided to the NEO Finance; iv) Investor doesn’t apply to the Lithuanian State Tax Inspectorate for a refund of the deducted tax from received interest.

Taxes in Lithuania

From received interest of EUR 45 NEO Finance deduct 15% of income tax. The deducted income would be EUR 6.75.

Taxes in Latvia

Assuming thatthe invetstor has received 3 payments of EUR 24 from the time of purchase of the investment (total EUR 72) and sold the investment on the secondary market for EUR 370, the total payments received (EUR 72 monthly payments and EUR 370 from the sale or repurchase of the investment) would exceed the initial investment (EUR 400) by EUR 72. This income will be subject to the applicable personal income tax rate of 20%, i.e. EUR 14.40. The tax must be calculated, declared and paid in the following year.

* Repayments received are all payments received for the investment made - principal, interest and penalties, as well as payments in the secondary market.

** The amount of investment made is the amount paid for the purchase of the investment on the primary or secondary market.

Personal income tax applies to individuals who are tax resident in Spain. Personal income taxpayers are taxed on their worldwide income.

A taxpayer is considered to reside in Spain if he/she spends more than 183 days in Spain during a calendar year, or if his/ herprincipal center or the base of his/her business or professional activities or of his/her economic interests is in Spain.

Taxable income is made up of a general base and the so-called savings base.

The savings base consists of the positive balance resulting from income from movable capital (including interest), and the positive balance resulting from capital gains/losses deriving from the transfer of assets (including transactions in the secondary market).

The savings base is taxed as follows:

19%, for the first €6,000 of net taxable savings income.

21%, for between €6,000.01 and €50,000.00 of net taxable savings income.

23%, for net taxable savings income of €50,000.01 onwards.

Examples:

No. 1.

Main clauses: i) During 2019 investor earned EUR 1 000 interest; ii) DAS-1 form was provided to the NEO Finance; iii) Investor apply to the Lithuanian State Tax Inspectorate for a refund of the deducted tax from received interest; iv) Investor contacted with Lithuanian State Tax Inspectorate and received certificate about income received and taxes paid in the Republic of Lithuania which was presented to the Spain tax administrator.

Taxes in Lithuania

From EUR 1 000 NEO Finance deduct 10% of income tax. The deducted income would be EUR 100, but in this example, we are assuming that investor will apply for a refund of the deducted tax and after the tax period has ended investor would get back EUR 50 of deducted taxes, because EUR 500 of interest from consumer credit provided through P2P platforms in Lithuania per year is non-taxable.

Taxes in Spain

Assuming that all saving base income is less then EUR 6 000, tax rate would be 19%. Taxes for EUR 1 000 of received interest would be EUR 190. If investor to the Spain tax administrator would provide certificate about income received and taxes paid in the Republic of Lithuania, then payable tax amount in Spain would be EUR 140.

Taxes in total EUR 190.No. 2.

Main clauses: i) During 2019 investor earned EUR 1 000 interest; ii) DAS-1 form was provided to the NEO Finance; iii) Investor does not apply to the Lithuanian State Tax Inspectorate for a refund of the deducted tax from received interest or contacted ; iv) Investor does not contact with Lithuanian State Tax Inspectorate for a certificate about income received and taxes paid in the Republic of Lithuania.

Taxes in Lithuania

From EUR 1 000 NEO Finance deduct 10% of income tax. The deducted income would be EUR 100.

Taxes in Spain

Assuming that all saving base income is less then EUR 6 000, tax rate would be 19%. Taxes for EUR 1 000 of received interest would be EUR 190.

Taxes in total EUR 290.

FOR INVESTORS FROM NETHERLANDS

The standard Dutch tax return has 3 category boxes for different types of taxable income. Box 1 applies to employment income and home ownership, Box 2 applies to income from a substantial interest in a company and Box 3 to worldwide savings and investments held.

The personal income (flat) tax rate for income from equity is 30% and is calculated over a (progressive) deemed interest made on equity (equity tax is also referred to as: “box 3”). In brief equity can be summarized as (worldwide held) assets minus (worldwide held) debts. The point of departure is the value of the equity per beginning (January 1st) of the relevant tax year to be taken up in your personal income tax return. Based upon this value the deemed taxable income (benefit from savings and investments) is calculated.

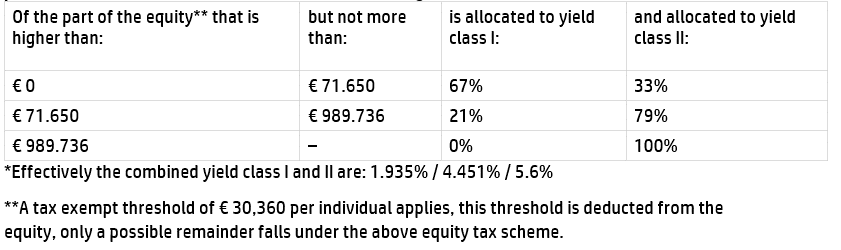

The benefit from savings and investments is set at 0.13% of the part of the basis for savings and investments that belongs to yield class I, plus 5.60% of the part of that basis that belongs to yield class II. The height of the part of the basis for saving and investing that belongs to yield class I or yield class II, is determined on the basis of the following (2019 rates) table*:

An example of the above equity tax table: A single individual has an equity of € 130,360 per January 1st 2019. After applying the threshold a taxable equity remains of € 100,000. The actual income made on this equity is not relevant, nor is relevant how this equity has been invested, e.g. as bank savings and/or (partially) invested in stock. Both the taxable interest as well as the kind of investment is fictitious. The first € 71,650 is effectively deemed to have made an interest income of 1.935% (67% x 0.13% plus 33% x 5,6%) is € 1,386. The second part € 100,000 -/- € 71,650 = € 28,350 is effectively deemed to have made an interest income of 4.451% (21% x 0.13% plus 79% x 5,6%) is € 1,261. Total deemed interest is 2,647 x 30% tax = total amount on equity tax is € 794.

This wealth tax means that there are no capital gains taxes for investments.